New Delhi: Public sector Oriental Insurance Company expects its balance sheet to show a huge jump in underwriting losses in its forthcoming results, due to an over 200% rise in motor insurance claims. Responding to the crisis-like situation, the insurance regulator is expected to drastically revise the premium for the compulsory segment of motor insurance, also known as third-party cover, this month.

The situation has been brought on as under the Motor Vehicles Act, owners of all commercial and passenger vehicles have to get themselves insured against claims for causing injury or damage to others. Own-damage claims are optional under insurance laws. Because third-party cover is a loss-making portfolio, private sector insurance companies avoid taking on premium for only such cover, but a large percentage of old private and commercial vehicles want only this insurance.Oriental and the other three public sector companies have to compulsorily take on such premium. As a result of the huge concentration of third-party cover in their motor insurance portfolio, the companies are bleeding.

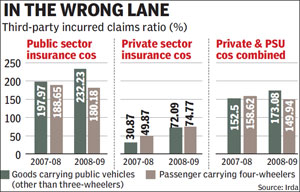

For 2008-09, the incurred claims ratio for Oriental was 237.76% for trucks and others. This means that of every Rs 100 the company earned, it paid out Rs 237 towards the third-party claim.

It has to dip into other portfolios to make good the loss. Obviously, the position is unsustainable.

The ratio was 232% for the entire public sector group, whereas it was 72% for the private sector companies. Once the Insurance Regulatory and Development Authority of India (Irda) revises the premium, there will be a sharp rise in third-party motor insurance premium. If the Irda draft guidelines on motor insurance premium rates for third-party liability cover are accepted, insurance premiums on trucks and buses would go up by 80% and for cars and two-wheelers by 10%. Data from Irda's Insurance Information Bureau show that that losses of both public and private sector insurers on their motor third-party insurance portfolio for commercial vehicles are going up consistently. In fact, Irda chief J Harinarayan said at a recent Ficci conference in the capital that general insurance companies have reported a combined loss of about R3,500 crore in the last fiscal on account of motor insurance claims.

He said that a final decision to increase the rates will be taken any time soon. “The liabilities in third-party have been immense and the rates for motor third party insurance must go up substantially. In view of the new liabilities, there must be nothing less than a 100% increase in rates,” says RK Kaul, chairman and managing director, Oriental Insurance. He adds that the Irda exposure draft that has proposed to increase the rates will ease the situation to some extent, but underlined that it was not enough. The Irda exposure draft is currently in the public domain and the authority will decide on the rates soon. While regulations on premiums in the non-life sector were withdrawn in 2007, third-party motor insurance continues to be regulated under the provisions of the Indian Motor Tariff Act.

The increase in rates has been on the cards for some time because of rising claims arising out of road accidents. Kaul explains that third-party motor insurance claims takes years years to mature, sometimes even eight years. “There is no time limit for filing the case as one can file it even five to six years after the accident, and once the case is filed, then it has its own procedures. In fact, motor third-party has always been bleeding the insurance companies portfolio as rates were always less than what they should have been.” To ensure that third-party motor insurance is not disproportionately loaded only a to certain classes of insurers, Irda constituted a motor pool five years ago to share the losses, which is currently running at a deficit.

Commercial vehicle owners have objected to the proposed steep hike in the third-party motor insurance premium and are advocating out-of-court settlements with accident victims.

No comments:

Post a Comment